Welcome to The Agency’s June property report for 2018. In this edition, I’d like to look at the current state of Australia’s property market and put this in context, given the end of what has been described as a recent ‘super cycle’ in key capital markets.

Historically property values move in five to seven year cycles and the most recent cycle has proven to be super-sized, particularly in Sydney and Melbourne. In the five years following June 2012, Sydney property values increased by 74.9 per cent and Melbourne property values by 59 per cent, with national capital city dwellings increasing cumulatively by 47.3 per cent as reported by CoreLogic. This extraordinary growth has been in part propelled by consistent, record- low interest rates.

There is little doubt the cycle has come to a close and we have entered a levelled market, but in my view the property market remains resilient, despite small value fluctuations. Given the number of factors impacting the real estate market today, we are still seeing significant buyer activity and there are greater opportunities for first home buyers and first-time investors.

Factors including changes to lending criteria and a reduction in foreign investment have played a role in shifting the market. The major banks have initiated greater lending restrictions reducing the availability of finance, with the Hayne Royal Commission promoting further lending controls. And, as recorded by the Foreign Investment Review Board, overall foreign investment in Australian property has reduced. Chinese investors are responsible for $1 in every $4 foreign dollars invested in Australian residential and commercial property and during the 2016 - 2017 financial year Chinese investment halved to approximately $15 billion from the previous financial year.

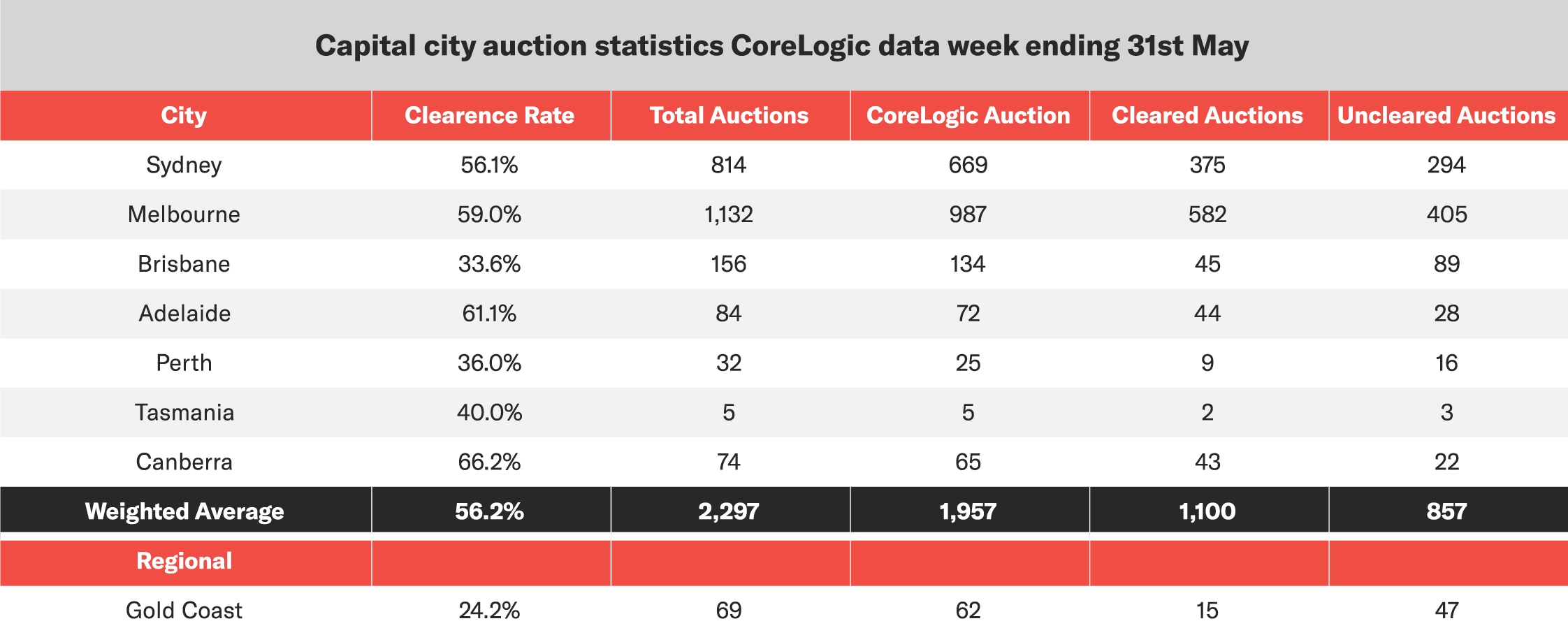

A stable and sustainable market is key, and we are in a process of adjustment where both vendors and buyers need to moderate their ‘super cycle’ expectations. The current reduction in auction clearance rates reflects this adjustment phase, with a high proportion of properties selling post auction. It is a matter of listening to market feedback and referencing recent comparable sales as a current price indicator, not a starting point for price expectations.

As reported by CoreLogic, over the last quarter Australia’s national market recorded a 0.3 per cent fall, with Sydney (-0.9%) and Melbourne (-1.2%) experiencing minor drops in value and the remaining capital cities recording minor increases or no change. In the month of May, we saw similar movements with the average value of dwellings nationally falling by 0.1 per cent and the combined capital cities average falling by 0.2 per cent.

These small value adjustments when compared to the recent exponential five-year growth cycle should be kept in perspective.

We are closing in on June 30 and it is an important time for those with investment properties to prepare for the end of financial year. If your investment property requires maintenance, repairs or minor renovations consider outlaying those costs now in order to reduce your taxable income for the 2017 - 2018 financial year. It is also worth visiting the ATO website addressing residential rental properties to ensure you are claiming all the expenses available to you.

Our experienced team is always on hand to help you with your property questions. We look forward to working with you.

Sydney Market

Sydney’s auction clearance rates may have fallen under 60 per cent, but this does not tell the full story of the city’s property market.

Thomas McGlynn, The Agency’s Director of Sales and Chief Auctioneer, has noted that although approximately 45 per cent of properties that go under the hammer each weekend don’t sell at auction, the vast majority get passed in on the highest bid and then sell post auction.

“If we look at the two-week clearance rate post auctions – or the 45-day clearance rate – I’d estimate it’s around 80 per cent, which is healthy in any marketplace,” Thomas explains.

“Properties are still selling and the clearance rate isn’t a good indication of how active buyers actually are right now. What clearance rates do show is that vendors’ expectations can be unrealistic on auction day.”

A few years ago, Sydney’s property ‘super cycle’ meant records were being broken weekly. Vendors looking to price their homes in that market could confidently add a premium onto recent comparable sales. Now conditions are more stable, buyers expect to pay similar prices to those that have been achieved in the past month. This is a balanced market where fair prices are achievable for both parties. It is a good idea for vendors to work with their agents on engaging buyers, looking to price their properties in line with recent sales.

The post-auction clearance rate illustrates buyer interest remains strong and we continue to see high numbers at inspections across our Sydney properties. We have witnessed a surge of sales in off-market and on-market top end sales across the Lower North Shore and Eastern Suburbs of Sydney. An example is 9 Morella Road, Mosman, which was sold for $6.88 million in May by Nic Yates. This was an outstanding price for the street. In fact, in the year to date, there have been nine sales above $10 million in Mosman.

While the pullback in foreign investment has affected outer areas such as the Hills District and Upper North Shore, there is still a wide range of interest from other buyer groups, including first home buyers, investors, downsizers and upsizers.

6A Liverpool Street, Paddington NSW

Perth Market

The Perth median sales price has been fairly static over the last six months registering between $510,000 and $520,000, resulting in lower sales volumes. However, this may be changing. In the first quarter of 2018, The Agency’s new listings were up approximately 20 per cent on the previous quarter.

It’s also good news for the rental market with the vacancy rate remaining stable at 4.1 per cent for April 2018, as recorded by SQM Research. On the ground, our agents are reporting more traffic through open homes and more enquiries on properties.

The top end of the Perth market is still going well, with clear signs of recovery in the $1.2 million – $1.5 million bracket. Sales and rentals around this price point were hit hard during the 2015-2016 financial year. This was when Perth’s population suddenly declined following the development phase of the resources boom ending. Buyers are growing in confidence and recognise this part of the market now presents exceptionally good value.

We’ve also seen a pickup in first home buyer activity in areas relatively close to the city. Meanwhile, on the fringes of the city, the state government’s $10,000 First Home Owner Grant (FHOG) scheme makes it more enticing for first home buyers to build.

“The bottom of the market has definitely turned, and if nothing else now would be a great time to enter the Perth market,” explains Stuart Cox, The Agency’s General Manager in Perth. “Confidence is definitely growing.”

According to REIWA, the suburbs experiencing the highest growth in median house prices include; Applecross (32.2 %), Nickol (28.1%), Bicton (23.2%) and North Fremantle (21.4%).

The top end of the Perth market is still going well, with clear signs of recovery in the $1.2 million – $1.5 million bracket.

19 Morgan Street, Shenton Park WA

19 Morgan Street, Shenton Park WA

Melbourne Market

Auction clearance rates in the Victorian capital now sit at around 60 per cent, slightly higher than in Sydney. But what this figure doesn’t reflect is that there is a higher proportion of homes going to auction in Melbourne, with stock levels sitting around 20 per cent higher than in Sydney.

Buyers are still active, The Agency team is frequently seeing two to three bidders at auction. However, these same buyers are becoming more price sensitive and vendors need to take this into account when setting their selling price and auction reserve. Starting with a realistic price at the outset encourages interest and generates competition. This is preferable to entering the market with inflated expectations and then chasing the market down.

We are still seeing some great results being achieved and much of the action is happening before the hammer falls. For example, vendors who fear a slow or unsuccessful auction are increasingly open to accepting pre-auction offers. Many others are avoiding the auction process altogether and are instead choosing to sell through a less urgent, off-market campaign.

Off-market transactions are on the rise and many of these are achieving strong results as illustrated over the past few months. Selling off market helps keep advertising costs down and ensures a level of privacy not available through traditional campaigns. Keep in mind though, this method is not suitable for all properties or all vendors, as you may need to wait longer for the right buyer to appear.

There are two categories of the Melbourne property market that remain particularly strong. First, there are some very attractive buying opportunities in the family home market in the inner ring of Melbourne, especially in the $2.5million to $3.5 million range. At the same time, the market in sub-$1 million apartments and townhouses remains strong, with young professional couples increasingly shunning renting and entering the market, often for the first time.

“With a more balanced market, there are some tremendous buying opportunities,” says Peter Kakos, The Agency’s General Manager in Victoria. “And for those looking to trade up in these areas, this is the best market we’ve seen in some time.”

13 Kerferd Place, Albert Park VIC

Gold Coast Market

The excitement and anticipation of the 2018 Commonwealth Games has passed and business on the Gold Coast is back to normal. The major difference being, residents can now enjoy the many infrastructure upgrades the city undertook in preparation for the games.

Looking back over 2018 to date, we can see the property market actually slowed down in the lead up to the Commonwealth Games. This was partially due to people’s attention turning to the impending games, but it was also the result of optimistic property owners getting caught up in the excitement and listing their properties for sale at prices beyond market value. These inflated prices did not match market expectations.

Post games, there has been a levelling of property prices and buyer activity has picked up across all price points. Our Gold Coast office, which opened last September, has had its best month ever this May, following a string of successful sales. There has been an obvious resurgence of interest in prestige real estate, including primely positioned beachfront houses and apartments.

As reported by CoreLogic in April 2018, the median house price on the Gold Coast sat at $640,000. But in a number of suburbs the median house price has cracked the $1 million mark, including; Bundall at $1.05 million, Broadbeach Waters and Clear Island Waters at $1.10 million, and Surfers Paradise at $1.35 million.

With a median house price of $1.562 million, Mermaid Beach is now officially the most expensive suburb on the Gold Coast and the fourth most expensive in Queensland. The Mermaid Beach median price rose an impressive 9.1 per cent over the past 12 months to April. This is first time a Gold Coast suburb has broken the $1.5 million mark.

“One of the key drivers influencing Gold Coast property values recently has been people moving from Australian capital cities to South East Queensland,” explains John Natoli, veteran Gold Coast agent. “During the 2016 to 2017 financial year, almost 20,000 new residents migrated to the Gold Coast, with just less than three quarters coming from Brisbane and Sydney combined, and Melbourne third in line.”

3184 Riverleigh Island Resort, Hope Island QLD

Finance with John Kolenda

The lending landscape in Australia has become much more complicated for home loan customers.

Despite the Reserve Bank of Australia leaving official interest rates at a record low of 1.5 per cent, mortgage holders can expect another round of out-of-cycle rate increases from lenders independently of the RBA’s decision due to the cost of funding pressures. These increases are already starting to flow through and we could see upward rate movements of more than 20 basis points.

If the lending environment wasn’t complicated enough, the spotlight on the banks from the Hayne Royal Commission into the financial services sector is making home finance more challenging. This is particularly evident through tighter controls on customer living expenses, which has resulted in borrowing capacity for consumers dropping 10 to 30 per cent over the past quarter.

These developments highlight how important it can be in the current environment to have the expert guidance of an experienced mortgage broker. Brokers can guide new home loan customers through the increasingly stringent application process and enable existing mortgage holders to secure the best terms and interest rates through their access to a wide variety of lenders.

With more than 3,400 rate products, significant differences between rates offered by competing lenders and widely varying qualifying criteria, navigating the 2018 lending market has become increasingly complicated without assistance. That said, it is important to remember despite the current finance changes, lenders are still vigorously competing for your business. There are still attractive deals to be obtained and a broker can help you secure the best option available. When it comes to your home loan it pays to be vigilant.

John Kolenda, Managing Director 1300HomeLoan

Investor's Corner with Maria Carlino

As first homeowners re-enter the sales market and interest rates sit at historic lows, much of Australia’s rental market is relatively flat. Despite vacancy rates remaining low, nationally they sat at 2.1 per cent during April according to SQM Research, yields have been stable or have fallen in some parts of the country. In the areas where investors have been forced to take less rent than they would have hoped for, it is worth considering signing shorter leases, with a view to re-assessing the price in three or six months’ time.

One segment of the market that is still highly competitive is well-presented family homes close to the city centres of Sydney and Melbourne.

Here, we’re seeing a new and strong demand from professional couples with children, these renters want to be close to schools, work and amenities. Often they’re looking for short-term rentals of around six to 12 months, usually because their own home is being renovated or rebuilt. Otherwise, they could be relocating for work and want to ‘try before they buy’, testing out a quality home in the type of premium area they’ll eventually be looking to purchase in.

For landlords looking to attract these affluent and established tenants, attention to detail is paramount. This includes renovating kitchens and bathrooms to a reasonable standard and equipping them with high-end appliances, in addition to presenting them attractively.

With competition among rental properties now heightened, presentation has become key in all market segments. If your property needs a refresh, now is the time to do it, in a tenants’ market, a well-presented property will always do better and achieve a better price than one that isn’t. And, with June 30 looming and repairs on investment properties usually tax deductible, it makes sense to do it as soon as possible.

That said, landlords should always be careful to claim correctly. The ATO’s new technology and data matching processes mean any discrepancies will be noticed. The ATO has also warned that any investors making claims that are disproportionate to the income they receive should expect extra scrutiny.

Maria Carlino, National Director of Property Management

New Projects with Steven Chen

Over 2018 The Agency Projects has procured and represented a cross section of projects on the eastern seaboard. These have comprised off-the- plan house and land packages, medium and high-rise projects, boutique high- end residential apartments, completed residential apartments and development sites. The focus has been on engaging projects that cater specifically to our client database, this includes premium quality builds, strong developer reputation and the optimum client return – in terms of investor yield and long-term capital growth.

The result has been significant activity in Sydney, Melbourne and South East Queensland working closely with prominent developers including Frasers Property, Metro Group and Shanghai-based SPG Investment Group. We have identified a critical shift by developers, with quality finishes, design efficiencies and well- thought-out planning and facility design the priority, ensuring value add and long-term benefits for the incoming owner.

This shift not only differentiates the project within the current competitive landscape, it adds intrinsic value and sustainability. While location, aspect and product size will always impact a buyer’s purchase decision, we are seeing factors like building facilities, greenspaces, concierge or resident managers having a larger impact on the purchase process than in the past.

We have seen increased activity by owner occupiers looking for house and land packages within the Sydney market, investor and lifestyle buyers from Sydney and Melbourne seeking Gold Coast apartments and a high level of interest on the Gold Coast from first home buyers looking into off-the-plan opportunities leading up to June 30. We have also seen a trend in SMSFs emerging, investing in the $450,000 to $500,000 range for Melbourne apartments. Another trend is homeowners utilising existing equity from their principal place of residence and investing in second and third properties along the east coast.

Our Site Sales and Acquisitions Division, along with our Development & Management Advisory Division, has seen solid uptake from developers. We have a number of significant transactions currently under due diligence, with others nearing completion, culminating in a purchase value of in excess of $100 million in the last quarter of the 2018 financial year.

Sydney and Melbourne-based developers in particular, are seeking apartment and retail opportunities in the south west corridor and house and land packages in the western suburbs of Sydney, with the view to commence construction in 2020.

With the addition of our Development & Management Advisory Division vertical our developer clients are now able to benefit from complete feasibility and cash flow projections, including internal rates of return. This is a compelling projects service that has been extremely well-received.

Steven Chen, Director of Projects

The Oxford Residences, 292 - 302 Oxford Street, Bondi Junction NSW